Want to Withdraw your EPF Money?

Contact A Leading PF Consultant for All Maharashtra!

- Simple Withdrawal Process

- Quick Response

- Affordable Pricing

- Genuine Service

- Well Trained Agents

- Available Across All Maharashtra

- Refundable Policy

Why "Online PF Services"?

Online PF Services is a leading PF Consultant offering a wide array of services for your PF withdrawal needs with unmatched expertise, a client-centric approach, and seamless service. More than just a service, it’s a delightful experience.

Affordable Fees

We offer competitive rates for our services, so you can get the most out of your retirement savings without breaking the bank

Wide Range of Services

We offer a wide range of services related to EPF withdrawal. Our experts will help you navigate the process with ease.

Comprehensive Support

We have committed to comprehensive support throughout the entire process with our years of experience in the industry

Maximize your PF withdrawals with Online PF Services !

Online PF Services is your expert companion in maximizing benefits from PF withdrawals for a secure financial future.

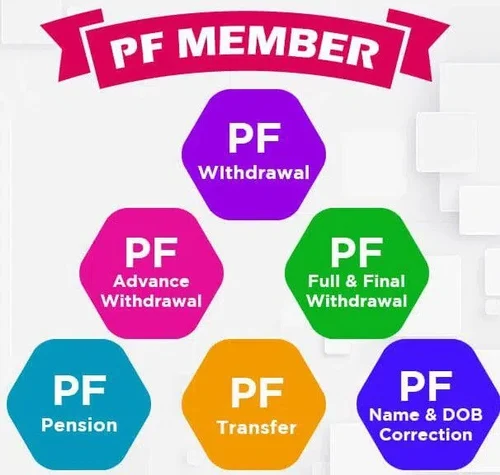

Our Services

Simplify your EPF withdrawal process and much more related to Labour Law with our user-friendly and hassle-free services at Online PF Services, your trusted PF Consultant.

Advance PF Claim

An Advance PF (Provident Fund) claim refers to a partial withdrawal of the accumulated balance in a Provident Fund account before reaching the retirement age or during specific circumstances.

Full n Final PF Claim

A Full PF (Provident Fund) claim refers to the complete withdrawal of the accumulated balance in a Provident Fund account, typically made when an individual is no longer eligible for its benefits, such as upon retirement, resignation, or changes in employment status

Pension Withdrawal Claim

A Pension Withdrawal Claim refers to the process through which an individual requests the withdrawal of their pension amount upon leaving a job or upon retirement, depending on the rules of the pension scheme.

Bank/PAN KYC

The bank and PAN KYC update in the EPFO member portal is essential for the following reasons:

Withdrawal: To enable smooth withdrawal of provident fund amounts, accurate bank details are necessary.

Keeping your KYC data updated ensures you can access your funds and benefits without issues.

E-Nomination

EPFO e-nomination is necessary because it ensures that:

1. **Quick Transfer**: Benefits are smoothly transferred to designated beneficiaries in case of the member's death.

2. **Clarity**: Clearly designates who will receive the funds, reducing disputes.

Overall, it simplifies the claiming process for family members during a difficult time.

Correction in EPFO

EPFO correction is necessary because:

1. **Accurate Records**: Ensures that personal and employment details are correct, which is vital for processing claims.

2. **Avoids Delays**: Prevents issues and delays in withdrawal or settlement of provident fund claims.

Correcting any discrepancies helps maintain the integrity of the EPF account and ensures a smooth experience for the member and their beneficiaries.

PF Withdrawal Consultancy Service